Unreimbursed Business Expenses 2024 W2 – Tax season is here and people are already on the lookout for when they can expect to get their W-2 and when they’ll be You can check the status of your 2024 tax refund by heading over . If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. .

Unreimbursed Business Expenses 2024 W2

Source : www.cnet.comQuality Business Solutions Inc. | Travelers Rest SC

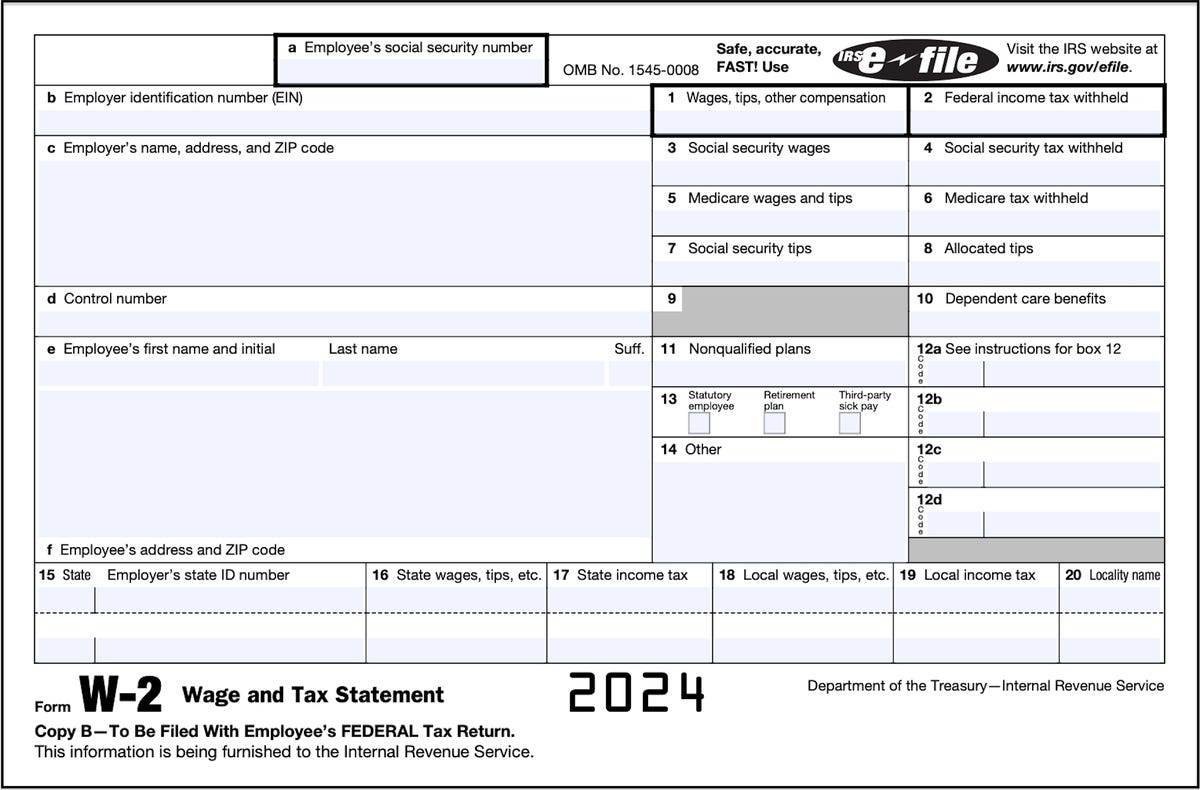

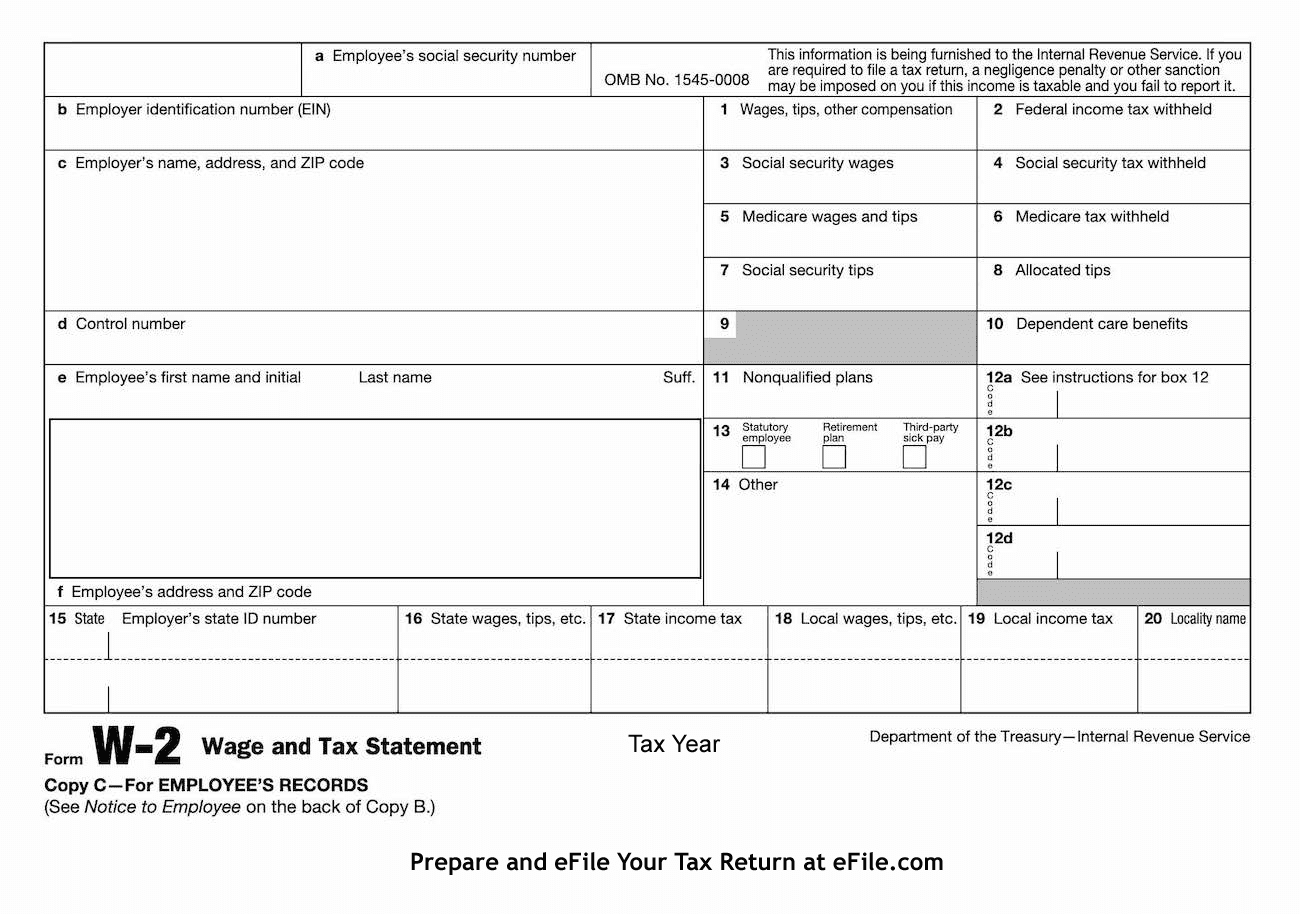

Source : www.facebook.comForm W 2, Wage and Tax Statement for Hourly & Salary Workers

Source : www.efile.comResource Management, Inc. | Fitchburg MA

Source : m.facebook.comExpired Tax Breaks: Deductible Unreimbursed Employee Expenses

AccessPoint

Source : www.facebook.comW 2 Deadline, Penalties, & Extension for 2023/2024 | CheckMark

Source : blog.checkmark.comSimplimd

Source : www.facebook.comDeciphering 2024 W 2 Boxes and Instructions BoomTax

Source : boomtax.comPlan Prepare Profit | Oklahoma City OK

Source : m.facebook.comUnreimbursed Business Expenses 2024 W2 What to Do if You Haven’t Received Your W 2 Yet CNET: No matter the nature of your financial circumstance, it’s likely that you’re looking for ways to cut back on your month-to-month expenses after or more a month in 2024 is to follow and . Amid rising costs for labor, services and materials, many businesses are looking for ways to reduce expenses Business Council members share how they’ll be reducing business costs in 2024. .

]]>